Proudly Servicing Canadian Customers

Minto Apartments, 1VALET, and Snaile team up to streamline parcel management

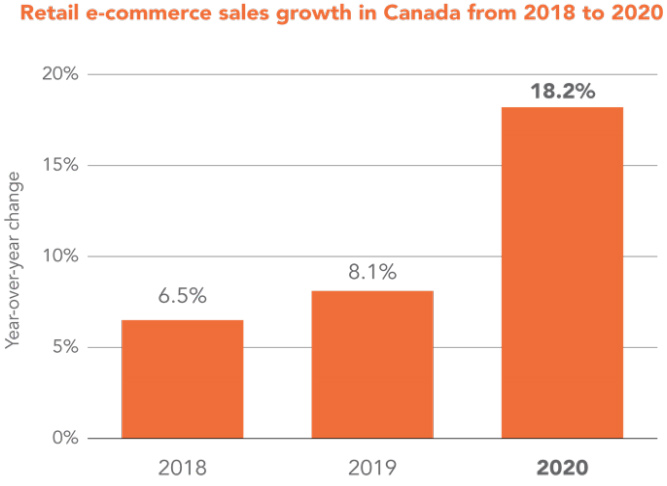

The pandemic continues to solidify and accelerate existing economic trends. The e-commerce industry experienced solid growth prior to COVID-19 and has emerged as one of few global success stories in the wake of the pandemic.

A May 2021 study by Statista Research Department showed that Canada experienced a 6.5% growth in retail e-commerce in 2018 and an 8.1% growth in 2019. According to separate data from StatCan, these numbers have skyrocketed over the past two years, with a massive 110.7% growth recorded between May 2019 and May 2020. Numbers peaked at $3.5 billion in January 2021, which represented a strong but relatively small percentage of total retail trade at 7.8%.

Current e-commerce growth is significant, as it underscores recent success while highlighting room for future growth.

Millennials account for 33% of all online shopping and represent 35% of online hyper-shoppers or people who purchase more than 25 items per year. In addition, according to a PwC survey of 1,000 Canadians, Gen Z is much more likely to buy online food items. These include everyday groceries, meal kits from companies like GoodFood and HelloFresh, and ready-to-eat deliveries from companies like Uber Eats, SkipTheDishes and DoorDash.

Younger generations will continue to shape the future of the e-commerce sector in Canada, with market reach only likely to grow as people get older, become more affluent, and gain access to more disposable income. Online food deliveries contribute significantly to parcel volumes in Canadian multi-family buildings, with this industry likely to grow alongside its customers in the coming years.

Over the next few years, Canadian multi-family buildings will see tremendous growth in the number of parcels coming through their doors, both food-related and otherwise. Nationally recognized carriers are planning for expansion, including huge names like Apple Express, Canpar, DHL, FedEx, Intelcom, Purolator, TForce, and UPS. There are also many smaller companies operating across Canada, with more than 10,000 courier companies continuing to fragment the industry.

For example, Amazon Canada uses 12 carriers to fulfill e-commerce orders, including its own Amazon Logistic service and multiple independent contractors. Most Amazon orders are delivered by independent carriers operating through the Amazon Flex program or through blue chips like Purolator and Canada Post. While these companies can deliver Amazon orders, they use their own tracking numbers and can’t deliver items to Amazon Hub Lockers or other Amazon delivery points

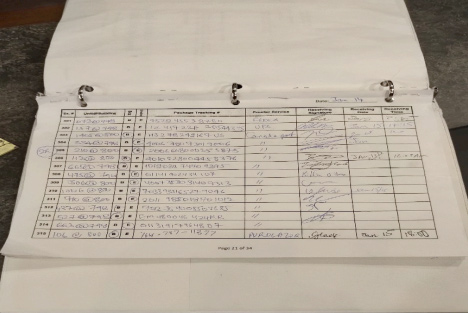

To put these issues into perspective, Snaile Inc. surveyed a 526-unit building in downtown Toronto on a normal day. In 24 hours, 131 parcels were delivered as per Table 1. Unknown carriers represented almost 20% of all deliveries. This number is only likely to increase in the coming years as e-commerce volumes grow, major carriers broaden their horizons, and small independent carriers pick up more of the slack.

| Delivery Company Parcel Count | Parcel Count |

|---|---|

| Amazon/Amazon delivery partner | 42 |

| Canada Post | 30 |

| Unknown | 24 |

| FedEx | 13 |

| UPS | 11 |

| Purolator | 10 |

| Canpar | 1 |

Increasing competition and fragmentation within the industry create several commercial and logistic challenges. Building access can be an issue, as can security, safety, and compliance concerns. For example, delivery drivers often drive unbranded cars or vans, with identification supported by little more than a high-visibility vest. With the number of deliveries only likely to rise in coming years, issues related to building access and security demand an immediate solution.

Methods of building access include the following two categories:

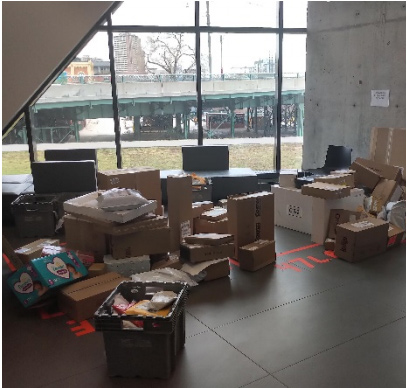

In the first “staffed” situation, the concierge is tasked with allowing delivery drivers into the building. The delivery makes its way to the concierge desk, where the parcel is received, signed for, logged (often manually), and stored. Once the resident has been notified, the parcel then needs to be located and logged out. This complex and time-consuming process takes about 10 minutes per parcel, according to surveys conducted by Snaile.

As a result, parcels often overflow at the concierge desk, which can cause security issues and fire code violations. Excessive combustibles in the common area are cited in Ontario Fire Code Section 2.4.1.1 – Accumulation of Combustible Materials.

In the second “unstaffed” situation, a dedicated “buzz for deliveries” button is typically used to notify the property manager or building resident. This button can be routed to the resident’s cell phone to enable remote entry. Some buildings don’t have this type of system and can only accept Canada Post deliveries. In this situation, a notice delivery card is left to indicate a failed delivery and the resident is required to fetch the parcel from a retail depot.

In most cases, smaller delivery companies will find their way into the building one way or another. Delivery staff are often paid per piece, with successful delivery noted with a simple picture of the parcel inside the building. There are many unauthorized methods used to enter buildings, including “buzzer bombing” or random button pressing and following other people past locked doors.

In this situation, parcels and failed delivery notices often overflow inside the building and can cause security issues and fire code violations. Excessive combustibles with respect to Accumulation of Combustible Materials blocking egress routes violates Ontario Fire Code 2.7.1.7.

There are penalties in place across Ontario for violating fire codes under the Fire Protection and Prevention Act Part VII 28. Convicted individuals are liable for up to $50,000 for a first offence and up to $100,000 or 1-year imprisonment for a second offence. Penalties are even worse for corporations, where a first offence can cost up to $500,000 and a second offence up to $1.5 million.

Along with fire code violations, parcels left in common areas can promote theft. It’s relatively easy for criminals to enter residential buildings and steal parcels, often using the same methods as delivery drivers. Parcels are sometimes stacked in hallways outside individual apartments, which highlights disposable income and indicates that the resident is not home. A recent survey published by FedEx found nearly a third of all online shoppers have experienced package theft in 2020 – compared to a quarter of shoppers a year prior. The survey also found that three in ten online shoppers are worried about their purchases being stolen upon delivery.

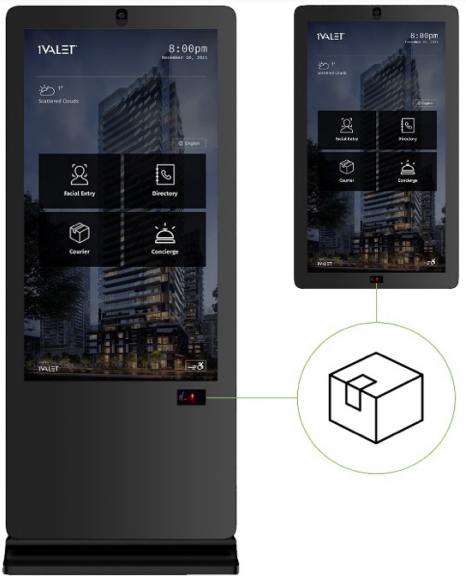

Canadian companies 1VALET and Snaile have joined forces with an integrated parcel delivery solution. They provide a complete end-to-end solution to ensure safety and security in multifamily buildings. Their first installation was completed in 2020 at Minto Apartment’s The Carlisle at 221 Lyon Street North in Ottawa, ON.

The solution is based on the industry-leading 1VALET smart entry system. This system includes a barcode scanner, which allows couriers to securely scan the package and grants them firsttime access into the building. The parcel carrier then makes their way to the Snaile locker to deposit the parcel. Upon delivery, Snaile pushes a one-time-use contactless QR pickup code to the 1VALET Resident App, which allows the resident to claim their parcel at the locker.

An integrated delivery solution solves all aspects of the multi-family building parcel problem.

Since the first Minto installation, Snaile and 1VALET have been awarded a contract for Minto’s 39 Niagara West property in Toronto, along with numerous other contracts for companies like Empress in British Columbia, Saroukian Group in Quebec, and Reid’s Heritage Properties in Ontario.

Since its humble beginnings in 1955, Minto Group has successfully built a fully integrated real estate company offering new homes and condos, rentals, furnished suites, and property and investment management. As one of Canada’s leading property management companies, the Minto Apartments Division proudly manages multi-resident units and commercial space in Ottawa, Toronto, Calgary, London and Montréal.

Minto Apartment REIT (MI.UN), is Canada’s only 100% urban residential real estate investment trust with multi-residential rental properties across Toronto, Ottawa, Calgary and Edmonton. The REIT’s 29 building portfolio offers a compelling long-term investment opportunity managed by a highly experienced team with a proven track record in the industry.

With expertise in construction and investment, Minto has built over 90,000 homes, managed more than 13,500 rental units, carries 2.3 million square feet of commercial space, and has an investment management portfolio worth $4.1 billion (as of February 9, 2021).

Minto has over 1,200 employees in Canada and across southern USA. It proudly builds better places for people to live, work, and play. With Minto, it’s all about special moments — like the thrill of moving into a new apartment, the pride of owning your first home, or the growth potential associated with a valuable investment partnership.

1VALET is a smart building operating system that integrates IoT technologies to better connect residents to their community, and easily convert any multi-family building into a connected smart building.

By centralizing building systems into one web-based dashboard and empowering tenants with a Resident App, 1VALET can enhance resident engagement, increase NOI, and create safer, smarter communities.

Snaile Inc. is Canada’s largest and most trusted parcel locker company, with its network operating in more than 55 Canadian towns and cities. As a proven service provider with a wide array of solutions, Snaile is trusted by 9 out of 10 large residential building owners in Canada.

Snaile has partnerships with all major Canadian parcel carriers, most property management software packages, and numerous smart building platforms. Snaile leads from the front as the national leader in multi-family delivery management, retail order fulfillment, and office tower parcel management.

As Seen in